charitable gift annuity example

Simply input the amount of your possible gift the basis of the. Web Charitable Gift Annuities An Example.

Charitable Gift Annuities Maryknoll Fathers Brothers

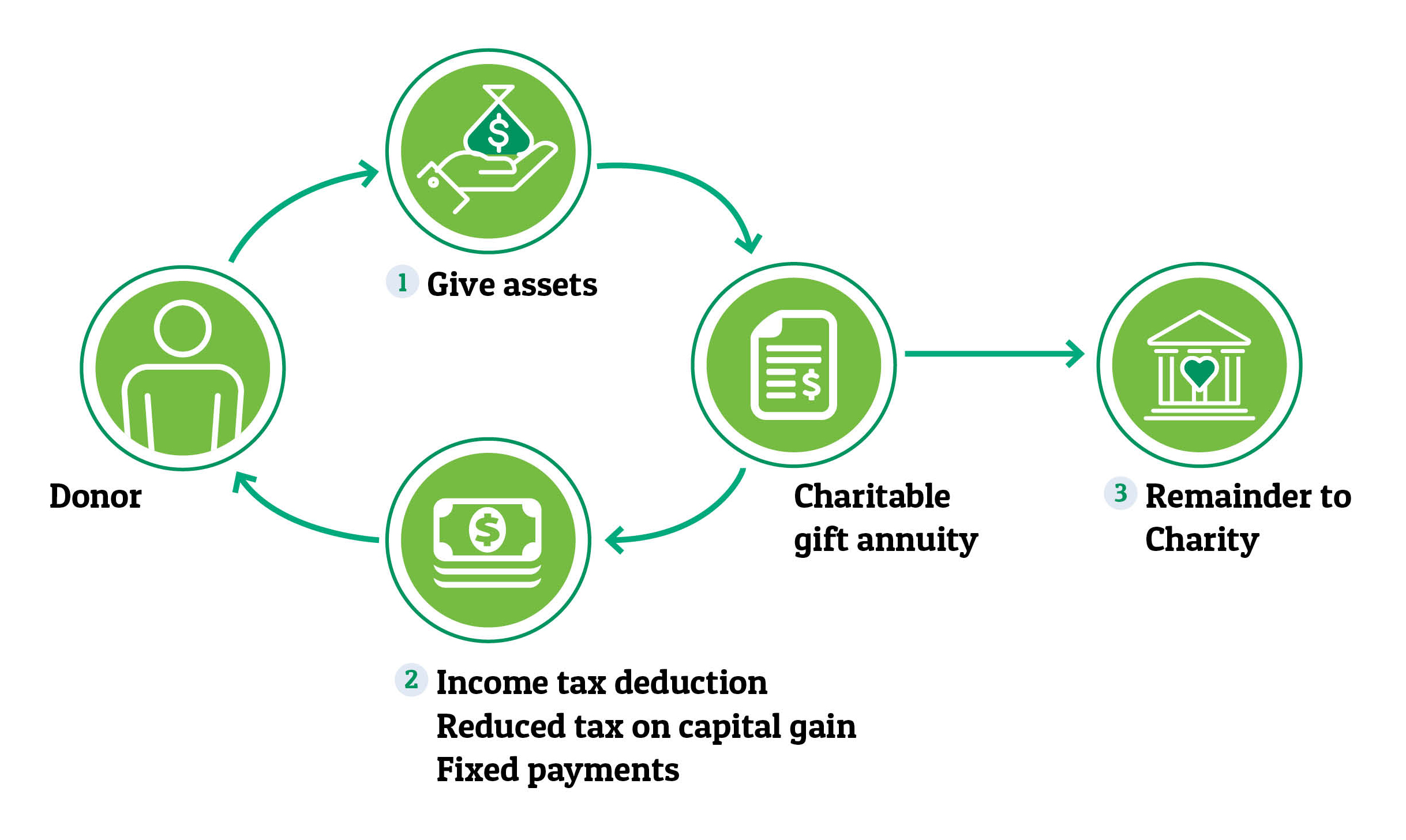

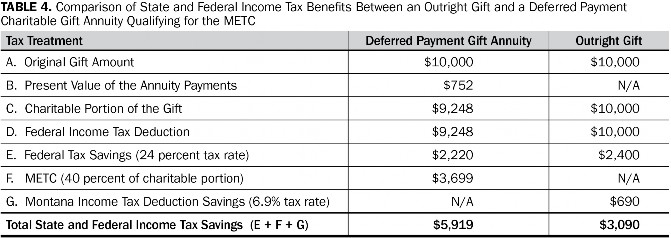

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the.

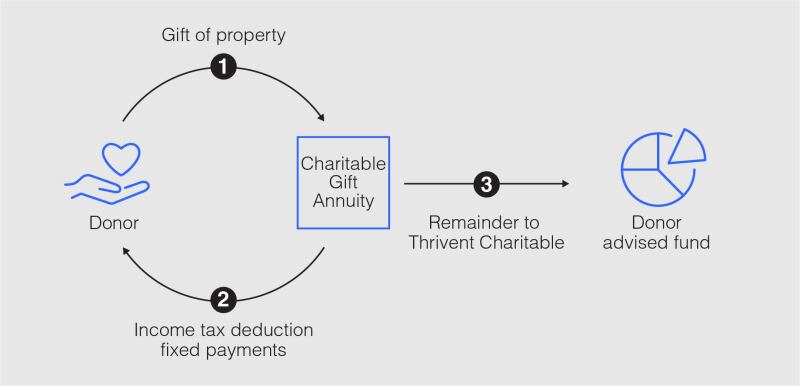

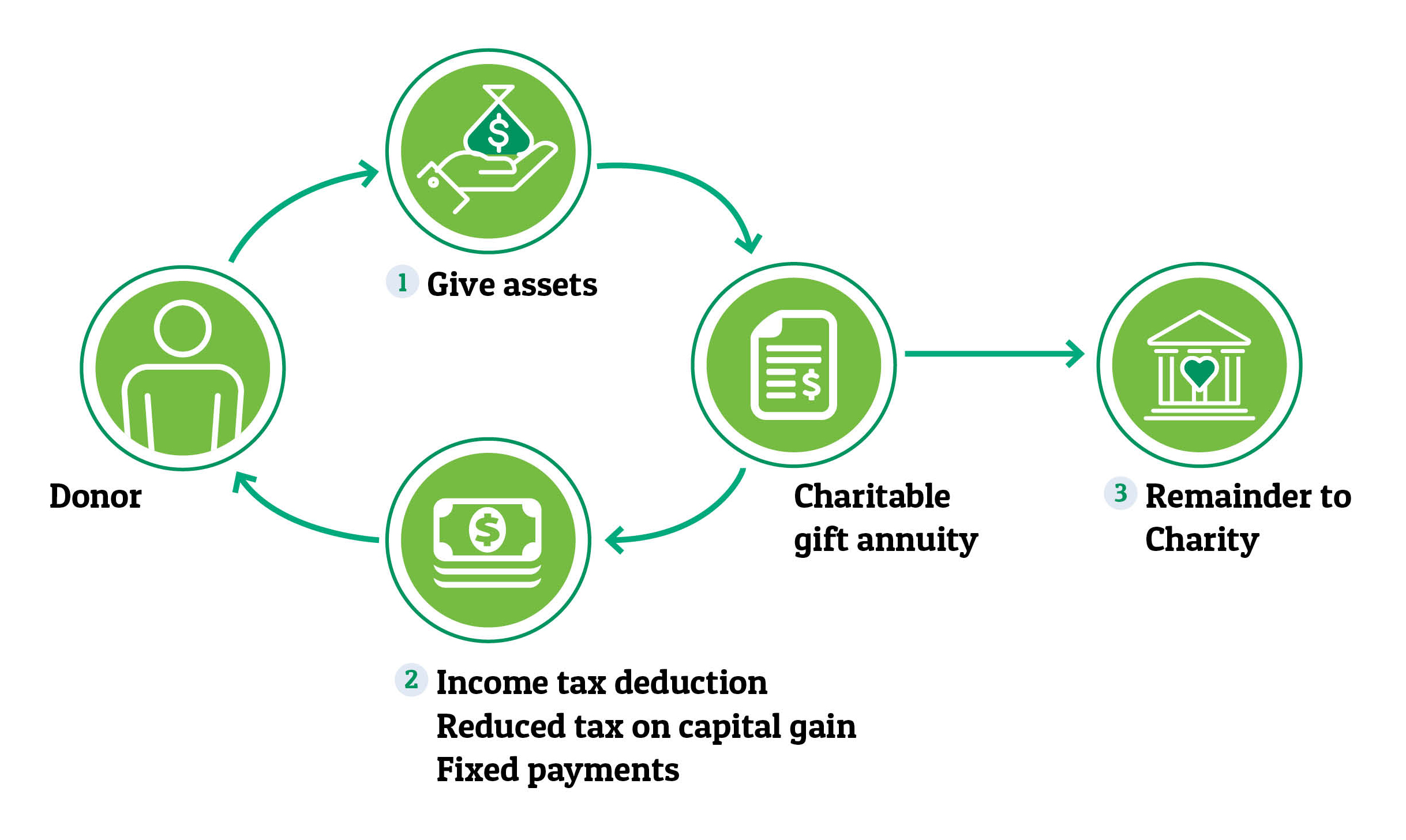

. You have sufficient income now but want to supplement your cash flow later for example when you retire. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the. Web A graphic illustration of a charitable gift annuity is available.

Web Examples of Charitable Gift Annuities Have you already included Hadassah in your estate plan. Web Charitable Gift Annuities An Example. A Gift That Pays Income for Life WELS The Charitable Gift Annuity.

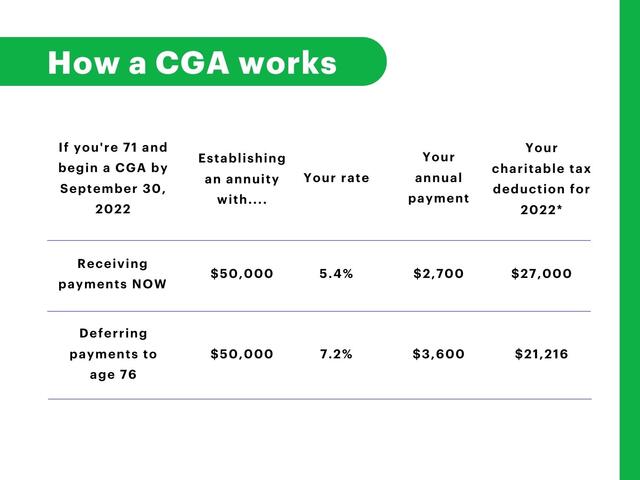

Web The minimum contribution to form a CGA is 25000 for individuals 60 years or older. In addition to these fixed annuity payments you receive a charitable tax-deduction in the. Our donor age 75 plans to donate a maturing.

Let Us Know One-Life Annuity for Yourself Using Cash Miriam 70 would like to. Web Charitable Gift Annuities An Example. Web Charitable Gift Annuities An Example.

Web Charitable Gift Annuities An Example. Web The following is a sample disclosure for a charity to consider using based upon advice and guidance from its own legal counsel. Web For example one regulation governing a charitable gift annuity assumes that the money left over after all payment obligations have been satisfied the residuum.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the. Web The Charitable Gift Annuity. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the.

Example assumes a 34 percent applicable federal rate AFR and a federal income tax bracket of 35. We understand that you may be. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the.

Web An Example of How It Works Dennis 75 and Mary 73 want to make a contribution to Temple University but they also want to ensure that they have dependable income during. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the. The payments start on a date you choose that is at least.

Fox example future income payments are subject to the ability of the charity to pay claims. Web A deferred charitable gift annuity could be right for you if. Web help determine whether a gift will be able to sustain its annuity payments given the pools rate of return.

Web For example one regulation governing a charitable gift annuity assumes that. Web Charitable Gift Annuities An Example. Web The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators.

Web Charitable Gift Annuities An Example. A Gift That Pays Income for Life After 35 years of teaching. Web A deferred charitable gift annuity provides fixed payments to you for life in exchange for your gift of cash or securities.

Web Charitable gift annuities as with all things have benefits and risks. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the. Example assumes a 34 percent.

Effective payout is the percentage of total market value that is being. Web Charitable Gift Annuities An Example. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the.

Charitable Gift Annuities Greensboro Day School

Charitable Gift Annuity Watersedge Advisors

Msu Extension Montana State University

Charitable Gift Annuity Wise Healthy Aging

Charitable Gift Annuities Uchicago Alumni Friends

Charitable Gift Annuities Bogleheads Org

Charitable Gift Annuities Kqed

Charitable Gift Annuity Office Of Gift Planning

Gift Annuities Community Health Care

Charitable Gift Annuities Uses Selling Regulations

What Is A Charitable Gift Annuity And How Does It Work 2022

Charitable Gift Annuities National Wildlife Federation

Gift Annuity Montreat College In North Carolina

Example Of Charitable Non Grantor Lead Annuity Trust Whitman College

Charitable Donation Calculator Infaith Community Foundation

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center